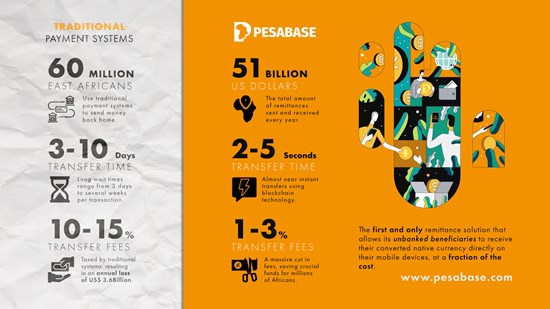

Pesabase Slashes Remittance Fees in Africa by 80% with a Blockchain Remittance Solution

Nairobi, Kenya–(Newsfile Corp. – September 13, 2022) – Pesabase’s newly unveiled blockchain remittance solution allows its beneficiaries to receive their converted native currency directly on their mobile devices at a fraction of the cost.

Pesabase with a Blockchain Remittance Solution

To view an enhanced version of this graphic, please visit:

http://images.newsfilecorp.com/files/8717/136546_c7ae2b21c4623bf8_001full.jpg

Pesabase and the newly released $PESA token’s founder and CEO Phil Somh, an African native turned successful Australian entrepreneur, has been building infrastructure with major Teleco companies and banks in Africa for 5+ years with 2 million dollars of seed funding. He unveiled a blockchain solution at a press conference last Friday that is set to disrupt one of the biggest innovation starved markets in the continent of Africa – remittance.

Every year African markets witness $51 billion of remittance sent and received and the users have been bound to 20-40% fees for decades. Pesabase aims to initiate a revolutionary step to banking the unbanked Africans who are still accustomed to using their SIM card as bank accounts.

Pesabase has achieved this technological leap by forging partnerships with large Teleco companies across the continent who act as de facto banks in lieu of a standardized banking system. Their innovative proprietary smart contract converts remittance from pUSD, (Pesabase stable coin) to local currency for the recipient. Pesabase also has forged deals with mini-banks across the continent to ensure that those who don’t use the Teleco system have points of contact to withdraw funds without hassle.

“Growing up in South Sudan and witnessing one of the worst famines in African history incited within me a deep passion for change in my homeland,” says founder and CEO Phil Somh at last Friday’s press conference in Sydney, Australia. “My first remittance sent to East Africa was $50. After sending the payment I was shocked to find I was charged a transaction fee of $21 to process this payment. Almost 50% of my remittance was lost to intermediary fees. Something had to be done to address this issue.”

Average remittance fees in Africa are currently 10-15%. Using Blockchain, Pesabase is slashing this to 1-3% on their platform. A massive cut of 80%, saving millions of Africans crucial funds for their goods and services. With such advancements, Pesabase has the long-term mission to forge financial freedom for millions of Africans who use the platform.

Pesabase has just recently launched the $PESA asset for public trading on exchanges as a way for both in and outside of Africa to get involved in the movement and invest in the technology underpinning Pesabase’s platform.

“For every remittance sent, the users receive $PESA tokens. These tokens can be traded on crypto platforms, and provide crucial holdings in a region where the average income is only $1.50 a day.” Phil and the Pesabase team believe that providing users with investment and stake in the platform, just for being users, provides education and financial inclusion in a much-needed sector.

About Pesabase

Pesabase strives to facilitate instant money transfers in Africa. Pesabase offers the best market rates and takes the issue of security seriously. It uses the latest encryption and blockchain technology to ensure their users’ funds security.

Further Details:

For more information, visit: http://pesatoken.io/

Website |Facebook | Twitter | LinkedIn

Media Contact:

Phil Somh,

Founder & CEO,

Upperhill Nairobi, Lower Hill Duplex next to Old Mutal Tower, office no.52

pesa@pesabase.com,

+61491208116.

To view the source version of this press release, please visit http://www.newsfilecorp.com/release/136546